does florida have capital gains tax on real estate

Ncome up to 40400. Ncome up to 40400.

How Much Is Capital Gains Tax In Florida Provise

Section 22013 Florida Statutes.

. Ad Due to the new tax laws relocating to Florida could have many tax advantages. Capital gains are the profits you make when you sell a stock real estate or other. Make sure you account for the way this will impact your future profits which will have an impact on your capital gains tax.

5 rows Does Florida Have Capital Gains Tax. As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home in Florida. 2021 2022 Long Term Capital Gains Tax Rates Bankrate Florida does not have state or local capital gains taxes.

This amount increases to 500000 if youre married. The Rules You NEED to Know 3 days ago Jul 12 2022 Its called the 2 out of 5 year rule. No one says you have to.

250000 of capital gains on real estate if youre single. The state of florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency. It lets you exclude capital gains up to 250000 up to 500000 if filing.

Weve Got You Covered. 1 week ago Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly.

Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet. Convert Your Home into a Short-Term Rental. The Three Types of Florida Real Estate Taxes.

The state of Florida does not have a capital gains. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. How do I avoid the capital gains tax on real estate.

What is the capital gain tax for 2020. It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale then up to.

Florida Capital Gains Tax. It lets you exclude capital gains up to 250000 up to 500000. Capital Gains Taxes Considerations for Selling Florida Real Estate.

500000 of capital gains on real estate if youre married and filing jointly. The IRS typically allows you to exclude up to. That goes doubly when you can avoid capital gains taxes on the first 250000 or 500000 in profits.

Its called the 2 out of 5 year rule. The long-term capital gains tax rates are 0 percent 15. However if you are in the 396 income tax bracket you will pay a 20 capital gains rate on your long-term capital gains.

Long-term capital gains tax is a tax applied to assets held for more than a year. The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. Individuals and families must pay the following capital gains taxes.

Make sure you account for the way this. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. Special Real Estate Exemptions for Capital Gains.

At 22 your capital gains tax on this real estate sale would be 3300. Generally Speaking Capital Gains Taxes Are Around 15 Percent For Us. Be sure you understand how to establish domicile in Florida by downloading our checklist.

Heres an example of how much capital gains tax you might. If you have owned and occupied your property for at least 2 of the last 5 years you can avoid paying capital gains.

1031 Exchange Florida Capital Gains Tax Rate 2022

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Selling Property In Florida As A Non Resident

Florida Capital Gains Tax The Rules You Need To Know Home Bay

Carried Interest Loophole To Close In Manchin S New Inflation Deal Effects On Real Estate Investments

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Short Term And Long Term Capital Gains Tax Rates By Income

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

State Capital Gains Taxes Where Should You Sell Biglaw Investor

How Are Capital Gains Taxed Tax Policy Center

How To Pay 0 Capital Gains Taxes With A Six Figure Income

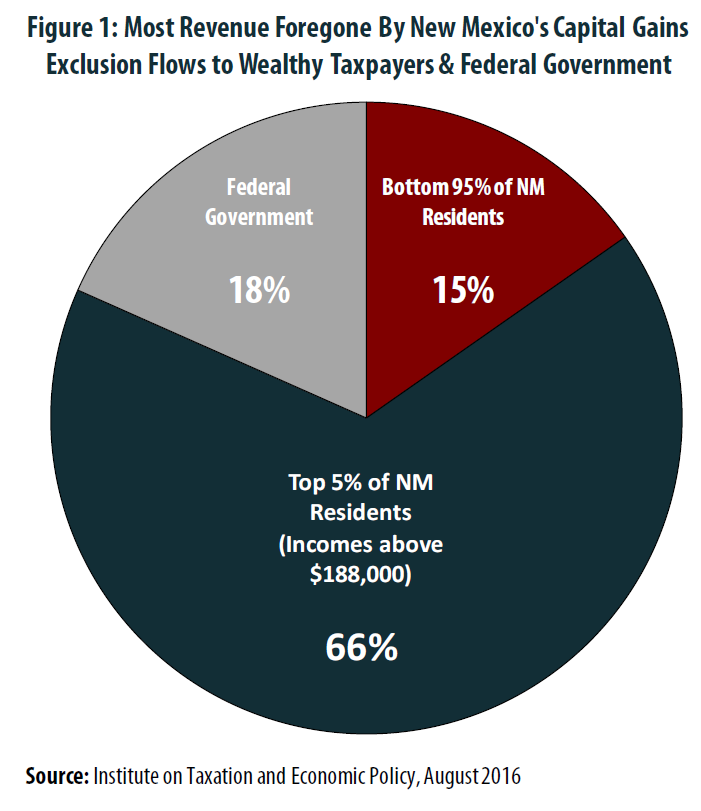

The Folly Of State Capital Gains Tax Cuts Itep

Real Estate Capital Gains Tax Rates In 2021 2022

Guide To The Florida Capital Gains Tax Smartasset

Capital Gains Tax On Home Sales

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains